"PayPal is on a mission to revolutionize commerce, globally, and today we are starting the next chapter," said Alex Chriss, President and CEO, PayPal. "With nearly 400 million consumer accounts, and 35 million merchant accounts, PayPal handles transactions for about a quarter of the world's e-commerce transactions each year, but more importantly, shoppers trust PayPal to power their payments."

Chriss continued, "PayPal is introducing six new innovations that will not only solve real customer pain points, but we believe will change the world of payments and commerce. From new solutions for merchants to speed up checkout and personalize offers, to a new consumer app that will give our loyal customers more reasons to shop with PayPal, to the next generation of Venmo designed to be the growth platform for local small businesses, PayPal has always brought the future of money to our consumers and merchants and today marks the next revolution."

With digital commerce expected to exceed $6 trillion in 20241, merchants need new, advanced ways to speed consumers through checkout in a seamless way that reduces lost sales. Additionally, consumers are continuously looking to stretch their budgets and get as much value while shopping as possible. PayPal's global scale and extensive data set, combined with the power of AI, will deliver the next generation of value for both consumers and merchants.

Transforming Checkout

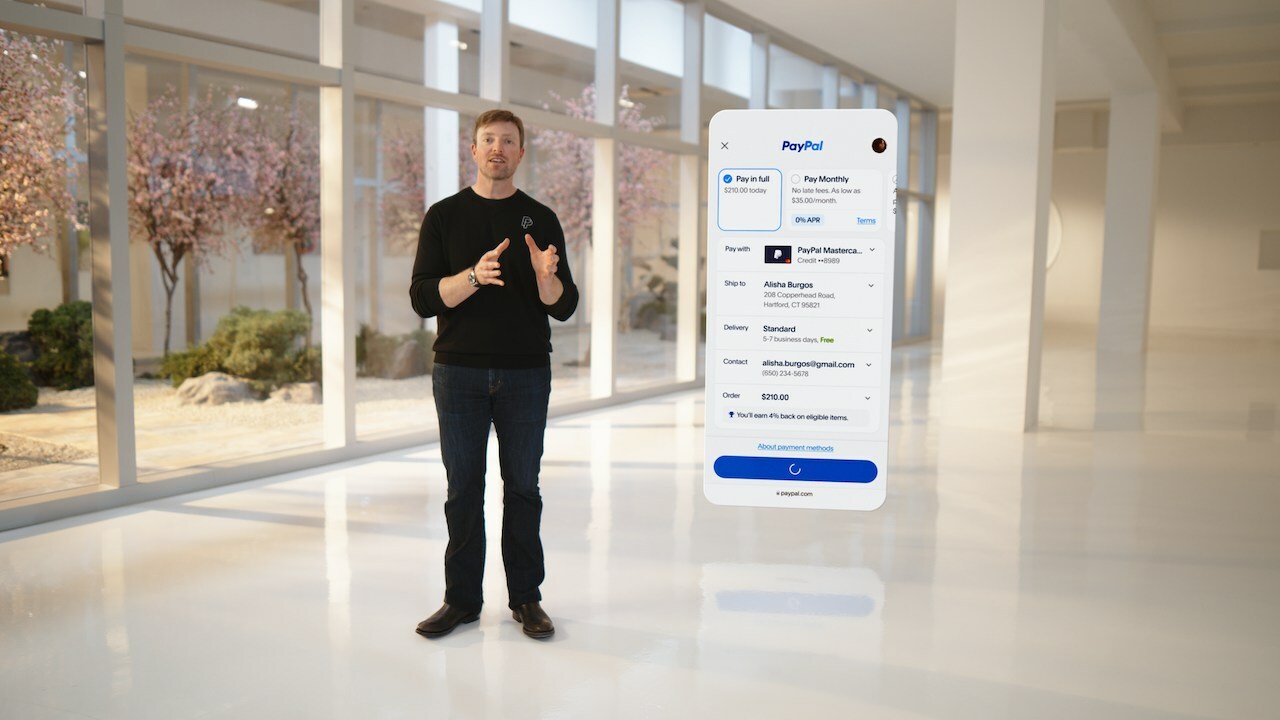

Checkout is the last interaction between a consumer and a merchant, and while it seems so simple, any friction can disrupt the moment. Business owners want to focus on the next sale and consumers are looking to remove any annoying interruptions like password prompts or lagging response times. To address this, PayPal has massively accelerated the checkout process to get customers to choose PayPal, integrate passkeys to enable customers to log in with their face or fingerprint with one tap, and to improve latency. In fact, this will reduce latency by as much as 50%2, and enable customers to check out twice as fast, all with the same level of security and trust they have come to expect from PayPal. Additionally, the new PayPal checkout will also leverage AI to get smarter and faster over time.

Introducing Fastlane by PayPal

Merchants are losing out on sales because the guest checkout process is both slow and cumbersome. Additionally, shoppers do not often sign in or sign up while browsing, and when they are ready to check out, they must find their password, update their credit card information, or shipping address. To help, PayPal is introducing Fastlane by PayPal, a new one-click guest checkout experience that merchants using PayPal's platform will be able to offer their shoppers, allowing them to make a fast and painless purchase. Customers simply save their information with Fastlane to check out in as little as one tap. No username or password to remember, no personal information to update, and no need to share a credit card with businesses all over the web.

PayPal has been piloting Fastlane by PayPal with a group of merchants and are seeing astounding early results. Select merchants on BigCommerce, a leading open software-as-a-service (SaaS) ecommerce platform and longtime PayPal partner, have seen early results showing that Fastlane can recognize 70% of guests and accelerated checkout speeds of nearly 40% compared to a traditional guest checkout process.

Introducing PayPal Smart Receipts

Merchants want to incentivize customers to come back, and consumers want to find the best deals, so PayPal is eliminating the guesswork for both with the introduction of Smart Receipts. When consumers shop with PayPal, they will receive a receipt that allows them to not only track their purchase, but also harnesses AI to predict what they may want to buy next from that merchant. As a result, now merchants will be able to include a personalized recommendation along with a cashback reward offer on the receipt.

As almost 45% of PayPal customers globally open their email receipts everyday5 – an incredible open rate – this could mean tens of millions of merchants and hundreds of millions of consumers seeing timely, hyper-relevant recommendations and rewards in these receipts. This increases the opportunities for merchants to re-engage directly with their customers, increasing the probability of repeat shopping and business growth.

PayPal is also leveraging AI-powered suggestions that are based on shopper behavior data, combined with the scale of what PayPal can see across the web. Through personalized AI, PayPal is giving any sized merchant the power of being one of the largest retailers in the world.

Introducing PayPal Advanced Offers Platform

Today, when consumers shop online their experience includes ads generated by their browsing behavior only, which can be irrelevant and frustrating. In response, PayPal will use unique customer insights to build a dynamic, truly personalized advanced offers platform giving merchants the ability to reach customers based on what they have actually bought across the internet, down to the stock keeping unit (SKU) and the individual product. This new, performance-based offers platform has the potential to use AI to organize and analyze data from nearly half a trillion dollars' worth of merchant transactions globally6. The platform will also allow merchants to customize offers for customers, and merchants will only pay for performance, not impressions or clicks. For PayPal consumers, it means they will get more relevant offers, and more opportunities to earn rewards.

PayPal is also building transparent, easy-to-use privacy controls so if a customer does not want their data shared with merchants to personalize their shopping experience – they can opt in or out.

Reinventing the PayPal app

PayPal is also reinventing the PayPal app to give loyal customers even more reasons to shop and pay with PayPal every day. Too often consumers are served the top items from the largest merchants that can afford to buy the best search terms. Additionally, consumers are still feeling the inflationary pinch and looking for ways to spend smarter and find the best deals. This is why PayPal is introducing CashPass to give customers access to hundreds of exciting, personalized cash back offers from top brands in the U.S. A user will simply need to tap on the offer, shop at that business, and check out with PayPal. CashPass uses AI to organize personalized offers for customers based on shopping behaviors, and customers will regularly discover new cash back offers giving them more reasons to visit the app.

Starting in March, PayPal is planning to launch CashPass with an amazing set of launch partners, so consumers can access offers from merchants such as Best Buy, eBay, McDonald's, Priceline, Ticketmaster, Uber, and Walmart.

PayPal CashPass users will also be able to stack with other PayPal rewards such as cash back from the PayPal Cashback Mastercard®. Users can then put cash back into a PayPal Savings account and earn more on top.

Introducing the Next Generation of Venmo Business Profiles

Venmo introduced business profiles in 2021 to provide an affordable and easy way for businesses to accept payments and grow their business and has grown to a community of more than 90 million active accounts. Small businesses rely on word-of-mouth, social media, and reviews on other sites for referrals. It can be difficult to stand out on social media, and one bad review can set their business back. Venmo is solving this by introducing enhanced Venmo business profiles to help small businesses be discovered like never before. The next evolution of business profiles will add subscribe buttons, profile rankings, and the ability to offer promotions to consumers, bringing powerful new ways for businesses to drive traffic, generate sales, and more meaningfully grow their business through increased visibility in the Venmo app.

For consumers, they will be able to discover top-ranked businesses endorsed by their network and enjoy cashback deals when supporting local businesses in their community. No other mobile payment service has a social feed as active, useful and as personal as Venmo, and this is a revolution in providing real-time offers and promotions at a hyper-local level for small businesses. The same type of privacy controls will be available on Venmo, as on PayPal.

All of these new experiences will begin rolling out in the United States throughout 2024.

For more information, visit http://www.paypal.com/us/whats-new/first-look.

SOURCE PayPal Holdings, Inc.

No comments:

Post a Comment